14 year old girl charged with murder after police say she tied down and killed an animal rescue advocate

PHILADELPHIA — A 14-year-old girl was arrested and charged with murder after police say she tied down and killed a 59-year-old Philadelphia man known for his animal rescue efforts.

Philadelphia police said they responded early November 5 to a report of a man in distress. Police entered the home and found a man, later identified as Albert Chernoff, partially tied to the bed with a massive head wound and several slashes to his chest. He was pronounced dead at the scene.

A female was seen leaving the property before police arrived, and police released surveillance video from inside the home in an attempt to identify her. The girl, who is 14, arrived with her mother and two defense attorneys to turn herself in, police said.

She was arrested November 8 and a preliminary hearing is scheduled for November 27, court documents show. Given her arrest, the surveillance video has since been removed, police said.

Police have not named the girl.

Jane Roh, a spokeswoman for the Philadelphia district attorney, said officials have not decided whether to proceed in juvenile or adult court.

One of the teenager’s attorneys, Howard Taylor, told CNN the girl is currently in juvenile detention.

“It’s a very sad situation. Troubled girl. There’s a reason police aren’t saying much,” Taylor said. “There’s a lot more to it.”

When asked whether she was a victim, he said he “wouldn’t put it to that extent,” but added that “he wasn’t totally innocent, either.”

Chernoff was a well-known animal rescue advocate in Philadelphia. In the wake of his death, the makers of the documentary film “The Cat Rescuers” shared a short video of Chernoff, showing his cat tattoos, and praised his “warmth and affability.”

“The world is just a little bit colder today without this wonderful human being. Please take a moment to tell the cat rescuers in your life what they mean to you. We will never forget you, Al,” their Facebook post read. “We lost a gracious soul.”

In addition, Animal Care and Control Team of Philadelphia praised him in a Facebook post after his death.

“The animal rescue community, and especially the cat community has lost an amazing man,” the group said. “He was one of the kindest people I’ve ever met and he would do anything for anyone. You are already missed and there is a hole in the heart of every cat rescuer that will never be filled.”

Photo Credit: fox2now.com

Virginia doctor allegedly tied women’s fallopian tubes, performed hysterectomies without consent

Federal prosecutors have accused a Virginia doctor of performing surgeries on women — such as hysterectomies and removing their fallopian tubes without their consent according to court documents.

Javaid Perwaiz, 69, faces several charges related to insurance fraud as a result of an investigation that began in September 2018 after the FBI received a tip from a hospital employee who suspected he was “performing unnecessary surgeries on unsuspecting patients,” according to the criminal complaint, filed Friday in the Eastern District of Virginia.

The unidentified patients would advise hospital staff that they were there for their “annual clean outs” and were not aware of the procedures they were undergoing, the affidavit states. In addition, hospital staff “had a difficult time” keeping up with the doctor “as he ran from procedure to procedure,” charging documents say.

Perwaiz has a practice in Chesapeake, where he lives, according to the court documents.

A preliminary review of Medicaid claims from his patients revealed that certain patients were subjected to repeated surgical procedures, with some occurring on an annual basis, the affidavit states. From January 2014 to August 2018, Perwaiz allegedly performed surgery on 40% of his Medicaid beneficiaries, which amounted to 510 patients. About 42% of those patients underwent two or more surgeries, according to the court documents.

The review also revealed that Perwaiz allegedly had a “propensity to conduct bundled surgeries,” involving laparoscopy, dilation and curettage, and lysis of adhesions, the affidavit states.

On one patient, Perwaiz allegedly performed annual D and C surgeries based on a diagnosis of endometriosis, according to the court documents. On at least one occasion, she was scheduled for the procedure without having appeared for an office visit, and in 2011, Perwaiz allegedly treated her for an ectopic pregnancy.

From 2011 to 2014, Perwaiz allegedly asked the patiently “routinely” whether she planned on having another baby, the affidavit states. In 2014, when the patient sought treatment from a fertility specialist, that doctor advised her that “both fallopian tubes were burnt down to nubs, making natural conception impossible.”

The court documents alleges that Perwaiz removed that patient’s fallopian tubes without her consent or knowledge.

(MORE: Georgia medical board suspends doctor accused of filming videos during surgeries)

In another case, in 2012, federal prosecutors say the patient thought only her ovaries would be removed but was “shocked” when she awoke from surgery to discover that Perwaiz allegedly performed a full hysterectomy, which he documented as an “elective surgery”on her medical record. That patient learned that there were less invasive procedures available when consulting with another doctor, according to the court documents.

The last surgery listed in the court documents occurred on Oct. 19 of this year, in which Perwaiz allegedly performed an abdominal supracervical hysterectomy, bilateral salpingo-oophorectomy and lysis of adhesions on a patient who later told investigators that she “never made complaints” regarding pelvic pain, pelvic pressure or constant cramping, despite what was written in her medical chart on Sept. 30. The patient also stated that she told the doctor she did not want a hysterectomy, but he allegedly told her it was the “best option” and did not discuss other treatment options or the risk of surgery.

Perwaiz’s medical practice submitted three claims to Blue Cross Blue Shield for that patient on Oct. 28 and was later reimbursed $942.22 for the partial hysterectomy, according to the affidavit.

Federal prosecutors have charged Perwaiz with “executing a scheme” to defraud the Virginia Medical Assistance Program and Blue Cross Blue Shield by submitting false and fictitious claims from 2010 to about October of this year, according to the court documents. He is also be charged with making false and fictitious claims to Blue Cross Blue Shield for the patient he treated in October for providing her with medical care that “did not present with the symptoms listed” and that she did not need.

Perwaiz was arrested Friday and was still being held at the Western Tidewater Regional Jail in Suffolk, Virginia, as of Sunday. His attorney, Lawrence H. Woodward Jr., did not immediately respond to ABC News’ request for comment.

The affadavist lists other instances in where Perwaiz was under investigation related to his medical practice. In 1982, Perwaiz lost his hospital privileges at the Bon Secours Maryview Medical Center in Portsmouth, Virginia, “due to poor clinical judgment and for performing unnecessary surgeries” and had been invested by the Virginia Board of Medicine for performing surgeries, predominately hysterectomies, “without appropriate medical indications and contrary to sound judgment.”

Perwaiz was ultimately censured for poor record keeping, according to the court documents.

In 1996, Perwaiz pleaded guilty to two counts of tax evasion, and his medical license was temporarily revoked but later reinstated in 1998, the affidavit states. He has also been the subject of at least eight medical malpractice lawsuits, charging documents state, in which plaintiffs allege he “falsified patient records to justify a medical procedure, failed to use less invasive techniques, performed as many as 30 surgeries in one day, and provided substandard care that resulted in irreparable permanent injuries to three patients and life threatening injuries to another two patients.”

He was still wearing green scrubs when he made his initial appearance at the U.S. District Court in Norfolk, where he was ordered to be held without bond, according to the newspaper.

Photo Credit: Western Tidewater Regional Jail

Her boyfriend admitted child abuse but didn’t go to prison. She spent 15 years in prison for not reporting him

Tondalao Hall was arrested after her boyfriend left her baby girl with broken ribs. She didn’t hurt the child but still served 15 years over the abuse.

Hall, 35, was released Friday from the Mabel Bassett Correctional Center in McLoud, Oklahoma. She tearfully hugged her children, her siblings and many friends who had been waiting for her.

“I’m blessed and I’m humbled,” Hall told reporters outside the prison.

In 2004, Hall and her then-boyfriend, Robert Braxton, were arrested on child abuse charges after she took two of her youngest children to the hospital. Her 3-month-old daughter had broken ribs and a broken femur, according to the American Civil Liberties Union of Oklahoma, which is representing Hall.

In 2006, after serving two years in county jail, Braxton pleaded guilty to two counts of abuse. He was sentenced but given probation and released from custody, online court records show.

Hall got a much harsher penalty.

She pleaded guilty to enabling child abuse and was sentenced to a total of 30 years in prison, records show. Authorities said she failed to tell police about her boyfriend’s abuse.

Hall was denied commutation in 2018. But last month, the Oklahoma Pardon and Parole Board voted in favor of recommending the commutation of Hall’s sentence. Gov. Kevin Stitt approved the request on Thursday, leading the way to her release on Friday morning, a spokeswoman with the state’s Department of Corrections said.

“First and foremost, I want to thank God for making a way and for keeping me safe and sane during this season of my life,” said Hall in a statement released Thursday prior to her release.

“Secondly, for all the people God has placed in my life, my children and my family for sticking by me. Time and space cannot accommodate the list of people who have loved, helped, and supported me through all of this, so, to everyone who has, thank you and God bless you!”

Hall’s son, Robert, who was only 18 months when she went to prison, said the decision came as a pleasant surprise for the family. He said he didn’t expect his mother to be released so quickly after the governor’s approval but was excited to have her back home.

“I’m feeling great, I thank the Lord for this day,” Robert, 16, told CNN affiliate KFOR. The ACLU said Hall’s cousin cared for her children while she was behind bars.

As Hall walked to a car surrounded by her family and attorneys, she said her only plans were spending time with her children. At some point in the future, Hall added, she would like to find a way to help other incarcerated women.

Hall’s release comes days after hundreds of Oklahoma inmates left prison in the largest mass commutation in US history. More than 460 non-violent inmates were released before their original sentences were over.

The move is one of many prison reform efforts in Oklahoma aimed at reducing overcrowded prisons while helping low-level offenders build a life of self-sufficiency rather than reincarceration.

Photo Credit: Sue Ogrock/AP/CNN

When a Waffle House was short on staff, customers jumped behind the counter to help out

Late last Saturday night, Ethan Crispo had just left a friend’s birthday party in Birmingham, Alabama, and walked into a Waffle House around midnight to grab a bite.

Crispo told CNN only a single employee was working in the restaurant.

He described the cook’s face, as “awash in bewilderment,” at finding he was by himself managing the night shift.

More than 30 people were there eating, and there was just one man left to “fend off the incoming crowd of hungry, heavily imbibed customers,” Crispo said.

He became resigned to going home on an empty stomach.

But a customer finished his meal, asked for an apron and stepped behind the counter to wash dishes.

“It was a smooth transition,” Crispo, 24, said. “He just busted his butt and helped out.”

‘It was one of my most memorable experiences’

Crispo said he asked Ben, the lone associate working, who the man washing dishes was.

Turns out he didn’t work at the restaurant, nor did he work at a Waffle House anywhere.

Another woman, wearing a dress and heels, also stepped up. She walked behind the counter to get a coffee pot.

“At first I thought it was out of necessity, like she just wanted coffee,” Crispo said. But she was enlisting as a second member of the volunteer staff.

The two worked together in a team, busing tables, stacking cups and washing dishes. Meanwhile, Ben, the actual employee, manned the cash register and cooked at the grill.

The man washing dishes occasionally “had to ask Ben where stuff should go,” Crispo said, but otherwise it was as though though two strangers, without even talking to each other, had spontaneously learned to run a restaurant in tandem.

Pat Warner, a spokesman for Waffle House, told CNN the store had a miscommunication about the duty roster that night, and it had created “a little gap” in staffing.

“We’re very appreciative and thankful, but we do prefer to have our associates behind the counter,” Warner said.

He added that Waffle House restaurants tend to have a special sense of community. He recalled a similar time in 2014 when diners volunteered to keep a restaurant running when paid staff couldn’t get to work during Atlanta’s notorious Snowmageddon storm.

But, for Crispo it was the first time, and it’ll stick out to him for years to come, as an example of humanity at its best.

“I’ve never seen anything like this ever happen, nor will I again, probably,” Crispo said. “It was one of my most memorable experiences.”

Photo Credit: Courtesy Ethan Crispo

New York woman arrested for allegedly harassing 2-year-old with genetic disorder

A New York woman has been arrested for allegedly harassing a child with a genetic disorder, according to police.

Krista Sewell, 26, of Melville, allegedly posted messages threatening the child, who has a “severe genetic disorder that affects the skin” on Facebook, Instagram and a GoFundMe campaign benefiting the child’s family, according to a press release by New York State Police.

The Long Island woman also allegedly mailed threatening letters to the child’s home, police said.

The 2-year-old girl, Anna Riley, lives in Ulster County in the Hudson Valley and suffers from harlequin ichthyosis, which causes skin abnormalities that affect breathing and movement. Her mother, Jennie Riley, is outspoken on social media about the condition in an effort to educate people, The Associated Press reported.

Riley said her daughter was born with the “severe” condition and that she has “made a choice to educate people publicly on Facebook and Instagram,” according to AP.

On Sunday, after the news of Sewell’s arrest became public, Riley wrote on Instagram that she refuses for her daughter “to hide from her disorder with some sort of shame about having different skin.”

“One day she will have to go out on her own to face the world and I will do everything in my power to make sure she has the confidence that is needed,” Riley wrote. “I hope so much that people learn there is someone on the other side of their keyboards and it’s not ok to send hateful messages.”

Riley thanked authorities for their “diligence and dedication” as well as their compassion in investigating the case.

“Although I knew there was a possibility for negativity I never expected to receive the messages that were sent to me,” Riley said in a statement. “Over the past year I have fought a battle I never thought I would fight and I felt fear no mother should feel.”

Sewell was charged with aggravated harassment, stalking, and a hate crime with aggravated harassment, police said. She was still being housed in the Ulster County Jail as of Sunday, a representative for the jail told ABC News. It is unclear if she has retained an attorney.

Photo Credit: Ulster County Sheriff’s Office

Hospital seizes wages from patients working at Wal-Mart for unpaid medical bills

WISE, Va. — When a judge hears civil cases at the courthouse in this southwest Virginia town two days a month, many of the lawsuits have a common plaintiff: the local hospital, Ballad Health, suing patients over unpaid medical bills.

On a Thursday in August, 102 of the 160 cases on the docket were brought by Ballad. Among the defendants were a schoolteacher, a correctional officer, a stay-at-home mother and even a Ballad employee — all of whom had private insurance but were still responsible for a large share of their bill, the result of large deductibles and copayments.

Ballad, which operates the only hospital in Wise County and 20 others in Virginia and Tennessee, filed more than 6,700 medical debt lawsuits against patients last year. Ballad’s hospitals have brought at least 44,000 lawsuits since 2009, typically increasing the volume each year.

In nearly all such cases, the hospitals prevail. Only about a dozen patients showed up for the August court date in Wise, hoping to work out a payment plan or contest the claims.

“There is this new group of people who, on paper, look like they should be able to afford their bills,” said Craig Antico, founder of the nonprofit RIP Medical Debt, which buys and forgives outstanding bills. “They’re middle-class; they have relatively good credit ratings; they’re not transient. But they have these big deductibles, and they can’t afford their bills.”

From Delaware to Oregon, hospitals across the country are increasingly suing patients for unpaid bills, a step many institutions were long unwilling to take.

In some places, major hospitals now file hundreds or even thousands of lawsuits annually. Those cases strain court systems and often end in wage garnishments for patients.

In Milwaukee, for example, a nonprofit children’s hospital has sued 1,101 patients since the beginning of 2018 — more cases than it brought in the entire previous decade. The city’s only top-level trauma center filed 2,074 suits last year, more than double the prior year’s number.

And some of the country’s most prominent academic hospitals, including Johns Hopkins in Baltimore and NewYork-Presbyterian, also have sued more patients in recent years.

The hospitals say that they are turning to the courts more frequently as deductibles rise and patients owe more but that this practice affects a small fraction of their patients. They defend the suits as necessary to recouping outstanding bills and keeping health systems afloat. “We’re only pursuing patients who have the means to pay but choose not to pay,” said Anthony Keck, vice president for system innovation at Ballad Health.

But patient and consumer advocates say hospitals are making faulty assumptions about insured patients’ ability to pay. They also argue that the lawsuits and wage garnishments hit middle- and low-income populations, who struggle to keep up with the lost income. A cashier at a Providence Health hospital in Oregon reported having wages garnished for outstanding medical debt to her own employer. For one paycheck for 80 hours of work, she took home 54 cents after a garnishment and other deductions.

Wage seizures have led patients to sign up for public assistance programs, fall behind on bills, give up their insurance and take on credit card debt, according to interviews.

“I know I owe it, which is fine, and of course I want to pay it,” said Amanda Sturgill, 41, whom Ballad took to court. “It just seems like they want their money no matter what my situation is.”

Sturgill earns $12.70 an hour and gets health benefits working full time as an order processor for an audio equipment manufacturer. She is going through a divorce and supports four children.

Ballad sued her in June over $2,498 in outstanding debt for her teenage daughter’s back surgery. Sturgill set up a $150-a-month payment plan but often struggles to come up with the money.

“Sometimes, if I’m getting close to the payment date and don’t have the money, I’ll go to the flea market and sell some of my things,” she said. “We get by on a lot of cheap soup beans and sandwiches. It terrifies me because I don’t know what they’ll do if I fall behind.”

This type of medical debt collection has come under increased scrutiny from judges and state lawmakers. New York is considering legislation that would significantly reduce the statute of limitations on medical debt. Connecticut may reform its system to make it easier for patients, who rarely have legal representation, to navigate.

Some hospitals that have drawn media attention for suing large numbers of patients, including one nonprofit health system in Memphis, Tennessee, and another owned by the University of Virginia, have sharply reduced their use of medical debt litigation.

Others are ramping up the practice, often to patients’ surprise. “I am used to hospitals sending collection notices,” Sturgill said. “But I am not used to a sheriff coming to my door to deliver a court summons.”

A ‘Whole New Bucket’ of Debt

Over a decade ago, hospital executives could safely assume that patients with health insurance probably could pay their medical bills. In 2006, only about half of employer-sponsored health plans involved a deductible that workers had to pay out of pocket before their coverage would kick in, according to the nonprofit Kaiser Family Foundation.

Today, 82% of employers’ health plans have a deductible, and the average amount has nearly tripled, to $1,655 from $584. Low-wage workers are more likely to be offered high-deductible insurance, which is less expensive for employers.

Soaring costs are also common for those who buy their own coverage. Plans sold through the Affordable Care Act marketplace can have high caps on out-of-pocket spending: as much as $8,200 for an individual in 2020 and $16,400 for a family.

“There are some people who bought their own insurance and simply didn’t understand the limits of what they were paying for,” said Jessica Roulette, a lawyer with Legal Action of Wisconsin. “We see medical debt collection against people who have purchased marketplace plans that don’t seem to cover a whole lot.”

Nonprofit hospitals are obligated to provide charity care and other financial assistance but aren’t required to screen patients to determine their need. An insured person may have a low enough income to qualify, but a hospital is unlikely to check, industry experts say.

“There’s been an assumption that if you have insurance, you have the ability to pay,” said James McHugh, a managing director at health consulting firm Navigant. “But that’s not necessarily true anymore. There is this whole new bucket of patient debt, and hospitals aren’t sure how to deal with it.”

That means more lawsuits from places like Children’s Wisconsin, a nonprofit once known as Children’s Free Hospital. It filed 23 medical debt lawsuits in 2014 and 108 in 2015. Last year, it brought 671.

Children’s sued last year for amounts ranging from $46 ($270, with court fees) to $20,606. This year it has garnished the wages of workers at McDonald’s and Walmart, and of its own employees. Among them is Holly Edwards, a McDonald’s manager and single mother in Milwaukee who fell behind on payments for her 4-year-old’s $2,242 emergency room visit.

“It’s not that we’re choosing not to pay, but there are other bills,” said Edwards, 43. “My daughter has to eat, and if it’s choosing between that or paying a doctor bill, I’m going to choose her.”

Edwards was making $300 monthly payments to the hospital. But after some unanticipated expenses — a $450 exterminator bill for bedbugs was a big setback — she began sending smaller amounts, she said, acknowledging that she had not first cleared the lower payments with Children’s.

The hospital took her to court last fall and recently began garnishing a quarter of her wages: $420 from her biweekly paycheck.

Edwards worked 14-hour shifts to make up for the lost income but still fell behind on her mortgage.

“It makes you think twice about going to the doctor,” she said. “I haven’t been feeling well for a couple of months; there’s something wrong with my stomach, and everyone is like, ‘Go in, go in.’ But I just can’t. There will be more doctor bills.”

The children’s hospital cited two factors driving up its litigation: higher deductibles and a growing patient population. It says the lawsuits are a last resort, after other attempts to collect on patients’ debt.

The goal is “to seek a solution that avoids legal action,” the hospital said in a statement. “However, if the account remains unpaid and the family’s employment is verified, the account may be placed with an attorney.”

In New York, medical debt lawsuits are rare but on the rise, as at NewYork-Presbyterian, the city’s top-ranked hospital chain. Its medical debt lawsuits doubled to 515 between 2015 and 2016. In 2017, the hospital sued 779 patients over unpaid bills.

A NewYork-Presbyterian spokeswoman, Kate Spaziani, said the hospital’s “practices and policies have remained constant: We actively work with eligible patients to help them access our Charity Care and patient advocacy programs.”

In many instances, court fees and interest add to patients’ debt. In Tennessee, for example, where medical debt can accrue 10% in annual interest, bills can balloon if hospitals wait to collect.

David Crumley, 41, was uninsured and did not qualify for Medicaid when Ballad sued him for the $5,418 he owed. But in the seven years between a court ruling in Ballad’s favor and the start of his wage garnishment, that debt accumulated $3,336 in interest. The garnishment took $277 from his $1,247 biweekly paychecks for work as a forklift operator.

“As a parent, when you have to choose whether to pay the rent or keep the lights on because your paycheck is being garnished, that’s a hard thing to do,” said Crumley, who recently left that job and is now covered by Medicaid. “You sit there, and you’re so stressed out that you start crying, and your own daughter offers her change jar to you. What kind of person does that make me?”

Changing the System

Public officials have become increasingly concerned about the proliferation of medical debt lawsuits, which have drawn media attention to the practice at a nonprofit hospital chain in Memphis, Tennessee, a for-profit hospital in New Mexico and the University of Virginia health system.

A University of Connecticut report in June found that hospitals and doctors in the state had sued 80,000 patients for medical debt between 2011 and 2016. Consumer advocates and a state judge are now pursuing reforms, such as simplifying the process to request itemized bills, that would make the court more accommodating to patients, who typically represent themselves.

New York lawmakers introduced legislation last month that would cap the interest hospitals can recoup on medical debt at 3%, instead of 9%, and would shorten the statute of limitations to two years from six. The proposed changes could result in fewer and smaller judgments against patients.

The American Hospital Association, an industry trade group, has taken no official position on medical debt lawsuits. But in a statement, the group’s executive vice president, Tom Nickels, said, “As a field, we will always continue to look for new and better ways to work with patients who need help paying their bills.”

Some hospitals are creating financial-support policies aimed at patients with high deductibles. This year, St. Luke’s University Health Network in Pennsylvania introduced an assistance program for insured patients who can’t afford their medical bills.

“Two years ago we were not doing this, and now we’re getting 50 applications a week,” said Richard Madison, the network’s vice president for revenue cycle. “We don’t want people to go into bankruptcy because of us.”

St. Luke’s decision not to pursue medical debt in court reflects both its nonprofit mission and a desire to stay out of the headlines.

“It would be bad press, and we don’t want to be the organization that does that to people,” Madison said.

At the same time, he worries that St. Luke’s may become overwhelmed by requests for help.

“The program might have to be discontinued if too many people were using it,” he said. “We want the people who are truly burdened by our hospital bill and can’t afford to pay it.”

Ballad Health does not plan to change its litigation strategy. But Keck, the vice president, said the network was increasing its income limit for charity care, which could reduce lawsuits.

“We’re a health care system that has to pay bills,” Keck said. “We have to pay nurses and doctors and so on. We’re doing everything possible to keep things out of court, because it’s expensive for everybody.”

Sturgill, who is paying off her daughter’s back surgery, hopes to continue her payment plan and avoid wage garnishment. Her children continue to get treatment at Ballad.

“I’ve got copays for specialists that are $60,” she said. “Any little extra we have, it goes towards doctors. And sometimes you just don’t have any extra. I was trying to pay things here and there, when I had it. But then sometimes, I just didn’t have it.”

This article originally appeared in The New York Times.

via: https://currently.att.yahoo.com/news/cant-pay-medical-bill-hospital-170819820.html

Photo Credit: modernhealthcare.com

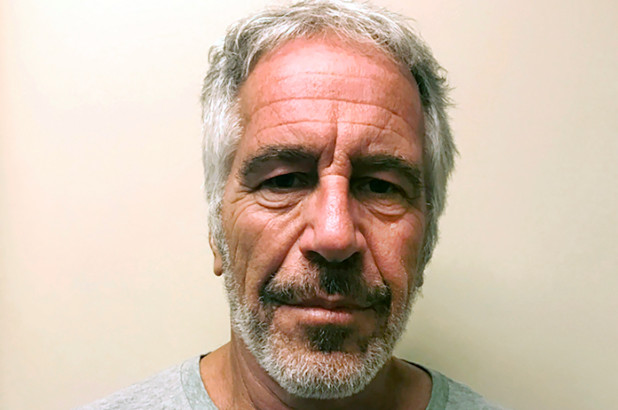

‘Epstein Didn’t Kill Himself’ printed on California brewery’s beer cans

The Jeffrey Epstein murder conspiracy is really brewing.

A California beer maker is selling a special, limited batch with “EPSTEIN DIDN’T KILL HIMSELF” printed on the bottom of its cans.

Tactical Ops Brewing started printing the special message Wednesday on the blue cans for the Freso-based firm’s Basher Oatmeal Stout.

Manager Carlos Tovar told Fox 26 that he got the idea about a week ago — which would have been when famed pathologist Dr. Michael Baden made international headlines by insisting Epstein’s autopsy “points toward homicide rather than suicide.”

Tovar said the Epstein conspiracies are “a big thing right now” — with his beer-can phrase exactly the same words as a former Navy SEAL blurted out at the end of an unrelated TV interview, making him go viral.

The company joked on its Facebook page that the boss’s dabbling in the conspiracy may see employees meeting the same shady endings.

“Tovar has sooooo got us all suicided. Lie and say nice things at our funerals,” the firm joked.

Only one batch — about 54 packs — will be made, the brewery told Fox 26.

Despite the latest uproar over Epstein’s death in his Manhattan lockup in August, New York’s chief medical examiner stood by her office’s ruling that the pedophile committed suicide. “We stand by the determination,” Dr. Barbara Sampson said.

via: https://nypost.com/2019/11/08/epstein-didnt-kill-himself-printed-on-california-brewerys-beer-cans/

Photo Credit: AP

Teenager stabbed to death while attending council-run knife awareness course for young offenders

The teenager stabbed to death at Hillingdon Civic Centre was attending a council-run knife awareness course for young offenders, police have revealed.

Hakim Sillah, 18, was killed after a fight broke out during the event in Uxbridge, west London, on Thursday.

The sixth-form student suffered a critical stab wound and died less than an hour after being airlifted to hospital. A 17-year-old boy was arrested and remains in custody.

Another 17-year-old, who was stabbed as he stepped in to break up the fight, was treated in hospital and has been discharged. Officers hailed his bravery as “amazing”.

DCI Noel McHugh, who is leading the investigation, revealed yesterday that the boys were young offenders and the Met Police confirmed they were attending a course designed to tackle knife crime.

He said he was not aware of any security present at the event or if the teenagers were searched for weapons. The knife used in the attack has not yet been recovered.

Selina Clarke, 18, from West Drayton, who went to secondary school with Hakim, said the council should have made sure there were no weapons being carried by people attending the course.

“They cannot have been searched properly otherwise they would have seen the knife,” she said. “It is so simple to put checks in place like a pat down or a metal detector that could have stopped it.”

DCI Hugh said: “It was a group session and a very quick altercation occurred between two individuals which resulted in one mail sustaining a knife injury which would cost him his life.

“My understanding is that it was a council event and there was no screening process but my understanding is that they would have carried out their own risk assessments. I wasn’t there, they may have done.”

DCI Hugh said the victim’s family were “absolutely broken” and that “it doesn’t feel real” for them.

Hakim, who was “always smiling and positive”, played football for his school team and had been awarded an apprenticeship to become an electrical engineer, friends said.

Hillingdon Council told The Daily Telegraph: “The matter is being investigated by the police and we are unable to comment further at this time. Our thoughts are with the victim’s family.”

Prime Minister Boris Johnson wrote on social media: “Very sad news from Uxbridge last night. My thoughts are with the victim’s friends and family.”

via: https://currently.att.yahoo.com/news/teenager-stabbed-death-while-attending-174330467.html

Photo Credit: SWNS

Popeyes employee caught allegedly selling chicken sandwiches as side hustle

Less than a week after it restocked its famous chicken sandwich, Popeyes has already seen the destruction of a car, a man screaming the N-word, numerous fights, and even a death. Now, an employee selling sandwiches as a side hustle can be added to that list.

TMZ got its hands on a video that shows Popeyes employees fighting behind the counter of one of its Los Angeles, California locations. Screaming can be heard in the video, as someone yells, “You fucking hit me, bitch!”

A source told TMZ that the incident started after one employee was caught selling the chicken sandwiches on the side. Multiple employees came together to fight the employee in question.

This happened not even a week after the fatal stabbing at a Popeyes in Maryland, an incident a Popeyes spokesperson described as a “tragedy.”

“We are saddened to hear about this senseless act of violence,” the spokesperson said in a press statement. “We, along with the franchisee, are fully cooperating with local authorities and actively working to gather more information.”

Of course, people have been talking about how great the sandwich is, or Justin Bieber who tried out the sandwich, and deemed it was “not worth the hype” on Instagram.

Despite all the madness it has caused, TMZ reports that Popeyes will not be removing the chicken sandwich from the menu.

via: https://www.dailydot.com/unclick/popeyes-employee-selling-sandwiches-fight/

Photo Credit: Dominic-Madori Davis

10 hospitalized after insulin administered instead of flu shots

OKLAHOMA — Ten people at a care facility in Oklahoma were hospitalized after they were injected with insulin instead of a flu shot, police said.

Eight of the patients were residents of Jacquelyn House and two were employees, Sgt. Jim Warring, with Bartlesville Police Department told CNN. The facility serves intellectually and developmentally disabled people, according to the website of AbilityWorks, the company that owns the eight-resident site.

EMS and fire crews responding Wednesday afternoon “found … multiple unresponsive people,” police Chief Tracy Roles said during a news conference covered by CNN affiliate KTUL.

Most patients’ suffering symptoms after the medication was administered “were not able to explain the issues,” Warring said. “Many of them are not vocal and not able to walk.”

“All these people are symptomatic, lying on the ground, needing help, but can’t communicate what they need,” Roles said. “That’s why I give a lot of praise to the fire and EMS staff for doing an outstanding job of identifying the problem.”

The pharmacist who injected the insulin was a contractor and went to the facility on Wednesday to administer the flu shot to residents and employees, Rebecca Ingram, CEO of AbilityWorks of Oklahoma, said in a statement.

Ingram said all people who received the injection had reactions and were taken to Jane Phillips Hospital in Bartlesville.

Several remained hospitalized Thursday due to the long-acting insulin that was administered, police said.

Ingram didn’t discuss whether the residents and employees were injected insulin but said authorities were investigating the “cause of the reactions to the injections.”

“I’ve never seen where there’s been some sort of medical misadventure to this magnitude,” Roles said. “But again, it could have been a lot worse. Not to downplay where we are, but thinking about where we could be, it could certainly have been very, very tragic.”

Tony D. Sellars, director of communications for the Oklahoma State Department of Health, said his agency will review the facility’s report on the incident “to determine if we need to follow up or if their action was sufficient.”

“There is no reason to suggest at this point that the facility should have had a reasonable suspicion that this sort of error would occur or be preventable on their part,” Sellars said.

An investigation was still underway on Thursday.

via: https://pix11.com/2019/11/08/10-hospitalized-after-insulin-administered-instead-of-flu-shots/

Photo Credit: pix11.com